Table of Contents

Introduction

Imagine a world where your smartphone is slower, your electric car’s battery drains too fast, or defence systems can’t keep pace. This isn’t science fiction; it’s a stark reality tied to the availability of strategic minerals – the unsung heroes powering our modern world and forming the very foundation of our technological civilisation. Unlike common minerals, these rare resources possess unique properties that make them vital for driving technological advancement and safeguarding national security.

Definition and Characteristics of Strategic Minerals

So, what exactly makes a mineral ‘strategic’? These are resources that are vital to a nation’s economic development and defence capabilities. The Colorado Geological Survey aptly defines them as “commodities essential to national defence for which the supply during war is wholly, or in part, dependent upon sources outside the boundaries of the U.S.”

However, their ‘strategic’ designation isn’t just about military importance; it’s a complex interplay of several crucial factors that make them indispensable yet vulnerable:

- Supply vulnerability: A high risk of disruptions, which can stem from geopolitical tensions, restrictive trade policies, or even environmental regulations in producing nations.

- Economic importance: Their irreplaceable role as building blocks for critical manufacturing and industrial growth across diverse sectors.

- Limited substitutability: The scarcity or complete absence of viable alternatives, meaning their unavailability would severely cripple technology and industry.

- Concentration of reserves: The often-uneven distribution of their primary reserves, frequently found in specific, geopolitically sensitive geographic regions.

Strategic vs. Critical Minerals: What’s the Difference?

While the terms “strategic” and “critical” minerals are often used interchangeably, there’s a subtle yet important distinction that shapes national policies and global resource strategies.

For example, lithium is widely considered a critical mineral, primarily because of its indispensable role in electric vehicle (EV) batteries and large-scale energy storage systems, underpinning broad economic transformation. In contrast, elements like uranium or titanium are typically classified as strategic, given their paramount importance in military applications and nuclear defence.

In essence, critical minerals are those vital for overall economic stability and growth, supporting a wide range of industries and technologies. Strategic minerals, on the other hand, are specifically designated for their direct impact on defence and national security needs.

This categorisation fundamentally hinges on two main parameters: their economic importance and their supply risk.

For a deeper dive into what makes minerals critical and why they matter so profoundly, explore our comprehensive primer on critical minerals.

Global Importance in Modern Technology

Strategic minerals aren’t just shaping our future; they’re actively rewriting the rules of our digital and sustainable world. Their demand is skyrocketing — the International Energy Agency projects that the need for these vital minerals will more than double by 2030 and potentially triple by 2040, potentially reaching 35 million tonnes annually.

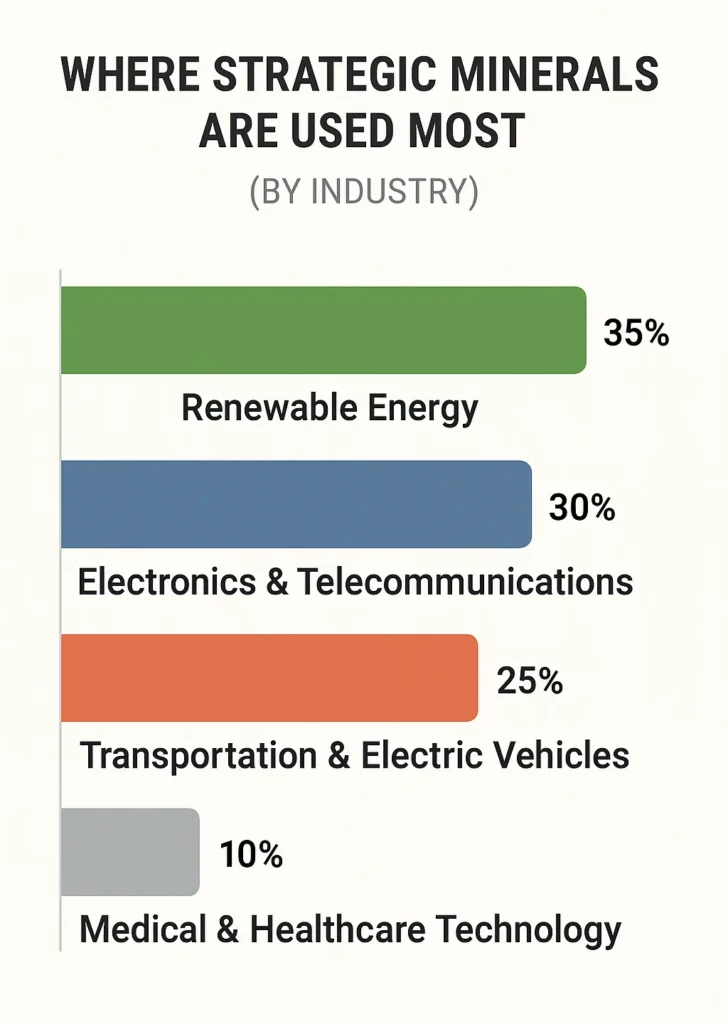

Why such exponential growth? These minerals are the indispensable building blocks across a multitude of cutting-edge technologies:

- Renewable Energy: Lithium, nickel, cobalt, and manganese are essential for batteries; rare earth elements power efficient wind turbines.

- Electronics: Indium, gallium, and germanium form the backbone of modern telecommunications and computing.

- Transportation: Cobalt, graphite, and lithium drive the EV transition.

- Medical Technology: Platinum group metals are used in life-saving devices and diagnostic equipment.

This technological shift demands an unprecedented scale of extraction. According to S&P Global, more copper will need to be mined in the coming decades than has been extracted in the past several thousand years — highlighting the immense challenge ahead.

Role in National Security and Defence

Beyond their role in everyday technology, strategic minerals are paramount to a nation’s ability to maintain military technological advantages. The U.S. Department of Defense has identified over 250 “strategic and critical materials” essential for supporting both military and civilian industries.

These minerals enable production of modern defence systems such as:

- Advanced weaponry and communication systems

- Stealth fighter jets — each using over 900 pounds of rare earth materials

- Nuclear submarines — requiring approximately 9,200 pounds of REEs

- Precision-guided munitions and night vision systems

As Adam Burstein noted, “Recent disruptions due to adversarial actions have underscored what we have long recognised — that it is more urgent than ever to build capability and resilience in supply chains for critical minerals” (source).

In response, nations are accelerating domestic mining, international partnerships, and strategic stockpiling — placing strategic minerals at the heart of 21st-century economic and geopolitical competition.

India’s Current Strategic Mineral Resources

Contrary to popular belief, India is rich in mineral diversity, producing 95 different types — from fuel and metallic to atomic and minor minerals. This positions the country at a pivotal moment in its strategic minerals journey.

Overview of Available Reserves

The Ministry of Mines’ detailed three-stage assessment process has identified 30 critical minerals crucial for India’s strategic development. These include elements such as antimony, beryllium, bismuth, cobalt, copper, gallium, germanium, graphite, lithium, and various rare earth elements.

These minerals are distributed across Indian states including Andhra Pradesh, Arunachal Pradesh, Bihar, Chhattisgarh, Gujarat, Jharkhand, Karnataka, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, Tamil Nadu, Uttar Pradesh, and the Union Territory of Jammu and Kashmir.

India’s mining sector is showing robust growth. In 2023–24, the total value of mineral production (excluding atomic, fuel, and minor minerals) reached ₹1,41,239 crore — a 14.83% increase from the previous year. Small mines form the sector’s backbone, with 2,036 mines reporting production during the period.

Top Strategic Minerals Found in India

India holds globally significant reserves in several strategic minerals:

- Rare Earth Elements (REEs): 5th largest reserves globally

- Ilmenite (Titanium): Holds 11% of global deposits

- Copper: 95% currently imported, but has untapped domestic potential

- Gallium: Extracted as a byproduct of alumina processing

- Graphite: 60% imported, yet notable reserves exist

- Cadmium: Byproduct of zinc production

- Phosphorus, Potash, Titanium: Industrially relevant, widely used

A major breakthrough occurred when the Geological Survey of India (GSI) announced the discovery of 5.9 million tonnes of lithium in Jammu & Kashmir — India’s first-ever lithium find. The deposit was discovered while exploring for limestone in the Salal-Haimana region.

Note: These lithium deposits are currently classified as “inferred resources” and are not yet commercially viable. Challenges include lack of advanced extraction technology and pending environmental clearances.

Comparison with Global Reserves

India performs well in global production rankings:

- 2nd in steel and aluminium

- 3rd in zinc and chromite

- 4th in iron ore

- 5th in bauxite

- 7th in manganese ore

- 11th in copper

- 12th in lead

- 17th in magnesite

- 19th in apatite and rock phosphate

Despite these strengths, India still imports critical minerals such as lithium, cobalt, nickel, vanadium, niobium, germanium, rhenium, beryllium, tantalum, and strontium. For instance, India imports:

- 80% of zirconium

- 60% of natural graphite

- 50% of manganese

- 2.5% of chromium

Import Sources: Lithium is mainly sourced from Chile, Argentina, Bolivia (the Lithium Triangle), Russia, China, Ireland, and Belgium. Cobalt is sourced from China, Belgium, the Netherlands, the U.S., and Japan.

To reduce this dependency, the Geological Survey of India (GSI) launched 368 exploration projects over the past three years. In 2024–25, 195 are ongoing, with 227 new projects planned for 2025–26. Strategic success hinges on both expanded local exploration and targeted international partnerships.

Critical Minerals List: What India Needs Most

India’s official list of 30 critical minerals — revised and endorsed in 2023, reflects those essential for the country’s clean energy, defence, and economic ambitions. They fall into four primary categories:

Rare Earth Elements (REEs)

India ranks fifth in global REE reserves, mostly of light rare earth elements (LREEs) like neodymium and praseodymium. However, heavy REEs such as dysprosium and terbium are not found in commercially viable concentrations.

REEs are vital for permanent magnets used in EVs, wind turbines, and defence technologies. Though India has mining and separation capacity via IREL, its refining and magnet-production capabilities are underdeveloped.

Indian Rare Earths Limited (IREL) plans to triple REE output by 2032, but experts caution that without downstream capabilities, India risks staying at the raw material stage of the value chain.

Battery Minerals (Lithium, Cobalt, Nickel)

These minerals underpin India’s energy transition. Lithium-ion battery demand is projected to grow from 15 GWh to 54 GWh by FY27 and 127 GWh by FY30.

- India is currently 100% import-dependent for lithium, cobalt, and nickel

- 5.9 million tonnes of lithium discovered in Jammu & Kashmir (inferred resource)

- KABIL acquired 15,700 hectares in Argentina for lithium exploration

- India holds 44.91 million tonnes of cobalt-bearing ore (mostly in Odisha)

- Nickel resources: 189 million tonnes (requires beneficiation)

Technology Metals (Gallium, Germanium, Indium)

Used in semiconductors and telecom:

- Gallium: Produced as a byproduct of alumina (NALCO & HINDALCO)

- Germanium: Fully import-dependent

In July 2023, China imposed export controls on gallium and germanium, disrupting global supply. China also dominates 90% of global rare earth processing, posing significant risks to India’s tech ambitions.

Industrial Metals (Tungsten, Vanadium, Titanium)

- Tungsten: Used in tools and military hardware; India recently fixed royalty rates

- Vanadium: Strengthens steel; rising use in grid-scale batteries

- Titanium: India holds 11% of global ilmenite deposits; 14 critical mineral blocks auctioned

Major Applications of Strategic Minerals in India

Strategic minerals are foundational to India’s key industries — from defence and energy to electronics and mobility.

Defence and Aerospace Applications

REEs are vital for high-performance magnets in guided missiles, radars, and surveillance systems. Each F-35 fighter jet uses approximately 417 kilograms of rare earths in systems like electric motors and electronic warfare units (source).

Titanium, with its high strength-to-weight ratio, is used in missile casings and aircraft engines. India’s limited access to heavy REEs (like dysprosium and terbium) poses a constraint on building indigenous defence platforms at scale.

Renewable Energy Sector Requirements

India’s energy shift requires a secure supply of minerals for solar and wind systems:

- Photovoltaics: Silicon, tellurium, indium, and gallium are used in solar cells

- Wind Turbines: Neodymium and dysprosium-based magnets power efficient wind generators

With solar capacity at 64 GW and wind expected to reach 140 GW by 2030, the demand for these minerals will grow substantially.

Electronics and Telecommunications

The digital economy runs on technology metals like gallium and germanium, which are crucial for semiconductor fabrication, fibre optics, and sensors. These underpin sectors such as space tech, robotics, and artificial intelligence — all vital to India’s Atmanirbhar Bharat ambitions.

Automotive Industry Needs

India’s EV revolution is mineral-intensive. Lithium, nickel, and cobalt form the core of lithium-ion batteries. The National Electric Mobility Mission Plan (NEMMP) aims to have 6–7 million EVs on roads by 2024.

According to the Economic Survey 2023–24, India’s EV market is projected to grow at a CAGR of 49% between 2022 and 2030, further intensifying mineral demand.

Challenges in India’s Strategic Mineral Sector

Despite its mineral potential, India faces several bottlenecks that hinder full-scale development of its strategic mineral supply chain.

High Import Dependency

India imports 100% of its lithium, cobalt, and nickel requirements. Additionally, China dominates supply chains for six critical minerals:

- Bismuth: 85.6%

- Lithium: 82%

- Silicon: 76%

- Titanium: 50.6%

- Tellurium: 48.8%

- Graphite: 42.4%

This dependence exposes India to price shocks and geopolitical disruptions.

Limited Domestic Exploration

Much of India’s mineral wealth remains unexplored due to the deep-buried nature of critical deposits. Private sector investment is low due to high-risk, long-gestation timelines, and regulatory ambiguity.

The Geological Survey of India (GSI) has stepped up with 368 exploration projects in the last three years — but scaling these remains challenging due to outdated methods, labour shortages, and seasonal mining limitations.

Technological Constraints

India lacks processing infrastructure such as hydrometallurgical plants needed for refining lithium or separating individual REEs. The lithium find in Jammu & Kashmir remains commercially untapped due to geological complexity and absence of targeted extraction technology.

Legacy mining methods, poor logistics, and skill shortages further slow down India’s movement up the mineral value chain.

Environmental Concerns

Mining causes deforestation, water pollution, and biodiversity loss. Heavy metal leaching threatens aquatic ecosystems and human health in nearby communities.

Green mining and recycling offer sustainable alternatives. Urban mining — extracting valuable metals from e-waste — is gaining traction through startups like Attero and Lohum, which are pioneering lithium and cobalt recycling solutions in India.

Conclusion

Strategic minerals are the backbone of India’s industrial growth and national security. While domestic reserves exist, challenges like import dependency, technological gaps, and environmental costs must be overcome.

The lithium discovery in Jammu & Kashmir is a turning point — but true mineral independence requires a mix of local exploration, international collaborations, and clean processing infrastructure.

India’s proactive steps — such as GSI projects, international ventures via KABIL, and legislative reforms — reflect strong policy intent. Going forward, India must:

- Build domestic refining and magnet manufacturing capacity

- Foster public–private exploration partnerships

- Develop green mining and recycling ecosystems

Just as India led the way in vaccine diplomacy, strategic minerals could become a lever of soft power — positioning India as a reliable partner in the global clean energy and technology value chain.

What are your thoughts on India’s journey towards mineral self-reliance? Share your views in the comments below.

FAQ

Q1. What are strategic minerals, and why are they important for India?

Strategic minerals are essential resources crucial for a country’s economic development and national security. For India, they play a vital role in various sectors, including defense, renewable energy, electronics, and automotive industries. These minerals are important due to their unique properties, limited availability, and critical applications in modern technology.

Q2. Which strategic minerals are found in India?

India has reserves of several strategic minerals, including copper, gallium, graphite, cadmium, phosphorus, potash, and titanium. The country also possesses significant beach sand mineral deposits and has recently discovered lithium reserves in Jammu and Kashmir. However, India still heavily relies on imports for many critical minerals.

Q3. How does India’s strategic mineral situation compare globally?

While India ranks high in producing some minerals, like steel and aluminum, it faces significant import dependency for many critical resources. For instance, it is 100% import dependent on minerals like lithium, cobalt, and nickel. The country is working on enhancing domestic exploration and production to improve its global position in strategic minerals.

Q4. What are the main challenges in India’s strategic mineral sector?

The primary challenges include high import dependency, limited domestic exploration, technological constraints, and environmental concerns. India lacks advanced technologies for extracting and processing some minerals, and balancing mineral extraction with environmental protection remains a significant issue.

Q5. How is India addressing its strategic mineral needs?

India is taking several measures to address its strategic mineral needs. These include increased domestic exploration projects by the Geological Survey of India, international partnerships for mineral acquisition, and policy initiatives to encourage private sector participation. The government also focuses on developing mineral extraction and processing technologies while promoting sustainable mining practices.