Table of Contents

🔎 30-Second Summary

The Lithium Triangle—spanning Chile, Argentina, and Bolivia, holds over half of the world’s lithium reserves and plays a central role in powering electric vehicles and energy storage systems. This article unpacks why the region is so geologically rich in lithium, how brine extraction works, and the geopolitical, environmental, and economic challenges each country faces.

From nationalization debates to global supply chain battles, you’ll gain a front-row view into the region shaping the future of battery technology. Ideal for readers tracking energy geopolitics, EV growth, or critical mineral sourcing strategies.

The Lithium Triangle stretches across three South American countries and holds our electric future’s destiny, with about 60% of the world’s lithium supply hidden beneath its salt flats. This vital mineral, often nicknamed “white gold,” is projected to see its demand surge 40-fold over the next two decades as the world moves toward renewable energy and electric vehicles.

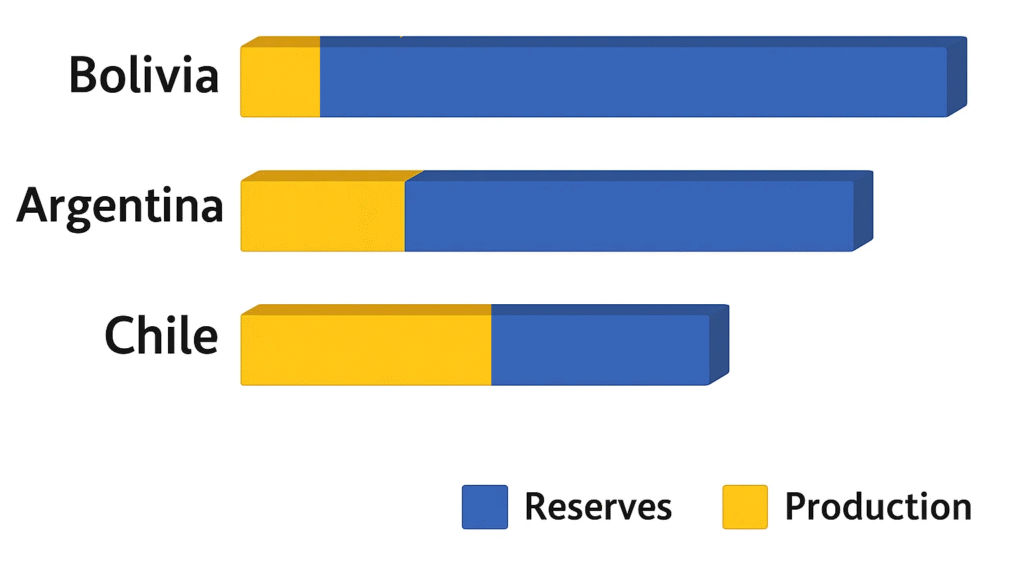

The United States Geological Survey reports that Bolivia has massive lithium reserves of 23 million tons. Argentina follows with 22 million tons, and Chile holds 11 million tons. This power concentration brings major challenges. Lithium extraction requires about 500,000 gallons of water per ton, raising serious environmental concerns across the region.

This article will show how South America’s powerhouse shapes clean energy’s future, dig into the complex relationships between major global players, and look at the challenges and opportunities ahead in the race to control lithium.

The Geography of White Gold: Mapping the Lithium Triangle

The Lithium Triangle sits high in the Andes mountains. It covers a vast area of about 400,000 square kilometers, including approximately 150 internal drainage basins across three South American countries (Wikipedia). People call this region “white gold” because of its valuable lithium deposits, which play a vital role in the transition to clean energy.

Where is the Lithium Triangle located?

You’ll find the Lithium Triangle in the Altiplano-Puna Plateau, spanning 500,000 square kilometers in the Central Andes and ranking as Earth’s second-highest plateau after Tibet.

The region stretches through northwestern Argentina, western Bolivia, and northern Chile, with some maps even including Peru’s southernmost parts (Wikipedia).

The region’s name doesn’t quite match its shape. Scientists note it looks more like a crescent than a triangle. This “Lithium Crescent” starts at Salar de Surire (19° S) and runs down to Salar de Maricunga (27° S) (Columbia SIPA). Salt flats (salars) dominate the area, creating some of Earth’s most stunning landscapes.

Three major salt flats mark the triangle’s corners: Salar de Uyuni in Bolivia, Salar de Atacama in Chile, and Salar del Hombre Muerto in Argentina (Columbia SIPA). Salar de Uyuni stands out as the world’s largest salt flat, covering 10,500 square kilometers—larger than Lebanon (Automotive Logistics).

The Three Countries Forming the Triangle

Bolivia: The Sleeping Giant

Bolivia holds the world’s largest lithium reserves. The USGS estimates about 21 million tons of lithium resources under its salt flats (Reuters). Salar de Uyuni contains roughly 11.2 million tons of lithium—about 38% of known global supplies (NS Energy Business). Yet Bolivia produces only 600 tons of lithium yearly (Wikipedia), showing the hurdles in developing these resources.

Chile: The Established Leader

Chile has fewer lithium resources than its neighbors (about 9.6 million tons) but leads in production, yielding around 140,000 tons of lithium yearly (Wikipedia). Salar de Atacama produces all of Chile’s lithium and has the world’s highest lithium concentration in brine at 0.15% by weight (CSIS).

Argentina: The Emerging Powerhouse

Argentina has 19.3 million tons of identified lithium resources (CSIS) and aims to become a major market player. The country runs about 85 lithium projects at different stages, with seven now producing. The provinces of Catamarca, Jujuy, and Salta lead production, with projects like Fenix in Salar del Hombre Muerto running since 1997 (Reuters).

Geological Conditions That Created Lithium Deposits

The Lithium Triangle’s rich deposits come from its unique geological past. The Altiplano-Puna region sits above one of Earth’s largest active magma pools (Wikipedia). Three main factors worked together over thousands of years:

- Mountain erosion: Water from the Andean peaks carried lithium carbonate and other salts (sodium, boron, potassium, and magnesium) from eroded rocks (CSIS).

- Closed basin formation: The area’s shape created enclosed basins where mineral-rich water collected with no path to the ocean (CSIS).

- Extreme evaporation: The dry climate gets less than 30 centimeters of yearly rain, causing heavy evaporation that concentrates lithium in the brines under the salt flats (Wikipedia).

The region’s volcanic activity helps too, as hot underground fluids keep filling the aquifers, adding more lithium over time (Wikipedia).

Global Race for Lithium Control: Major Players and Stakes

The 21st century’s geopolitical chess match has made the Lithium Triangle a battleground. Lithium needs are expected to grow four times by 2030 (HCSS), which has sparked a race among nations and companies to secure their share.

China’s Growing Dominance in Lithium Processing

The Lithium Triangle countries own the resources, but China has positioned itself at the supply chain’s bottleneck. Chinese companies now control 67% of global lithium processing, 73% of cobalt, 70% of graphite, and 95% of manganese (ICWA). China has also secured 41% of the world’s cobalt and most lithium mining operations. This didn’t happen randomly; the Chinese government poured $1.2 trillion into subsidies, rebates, and tax exemptions from 2009-2019 to dominate lithium refining (Next IAS).

Companies like Ganfeng Lithium and Tianqi Lithium are now among the world’s top three lithium miners (BBC Future). Ganfeng holds a majority stake in Argentina’s Caucharí-Olaroz operation, and Tianqi owns nearly a quarter of SQM, Chile’s biggest lithium mining company.

U.S. and European Interests in South American Lithium

The United States has started to counter China’s lithium advantage, creating the Minerals Security Partnership with Australia, Canada, Japan, South Korea, and European nations in June 2022 (BBC Future).

American policymakers see this as more than economics—it’s about national security. A lithium shortage could leave the U.S. without key defense items like drones and fighter jets (Next IAS). The Biden administration sees the Triangle as crucial to reaching a 50% carbon emissions reduction goal by 2030. But U.S. lithium companies have found it tough to gain ground due to China’s strong presence.

Europe faces its own lithium challenges. The EU Parliament expects demand to multiply 18 times by 2030 and 60 times by 2050. The Critical Raw Materials Act sets goals to mine, refine, and recycle lithium, aiming to source 10% locally by 2030. Companies like AMG Lithium are building massive refineries, and Northvolt aims to use 50% recycled lithium in batteries by 2030.

Local Government Policies and Nationalization Efforts

The Lithium Triangle countries are seeking more control. Chile’s President Gabriel Boric announced a plan to nationalize the lithium industry in April 2023 (Reuters). Existing contracts stay valid, but new ones will be public-private partnerships under state control (FTI Consulting).

Bolivia takes the most state-focused approach through its company Yacimientos de Litio Bolivianos (YLB). After ending a German partnership in 2019, Bolivia signed a deal with a Chinese group in January 2024. Argentina, meanwhile, offers the friendliest climate for investors, running 85 lithium projects at various stages (Fastmarkets). Some experts think Argentina might join its neighbors to form a “lithium OPEC,” driving prices up and making them less stable.

The Lithium Triangle countries could win this geopolitical competition if they balance resource control with technology partnerships to fully capitalize on their white gold reserves.

Lithium Reserves by Country: Who Holds the Power?

The future of lithium depends not just on who owns it, but on who can produce it. The numbers paint an intriguing picture of power dynamics among the Triangle countries and other lithium-rich nations.

Bolivia: The sleeping giant with largest reserves

Bolivia has the world’s largest lithium treasure, with resources totaling 23 million metric tons (Reuters). That’s about one-quarter of global lithium resources (NS Energy Business). Salar de Uyuni is the world’s largest salt flat and the biggest single lithium deposit visible from space.

Bolivia remains dormant despite owning 38% of global reserves (Wikipedia). It produces only 600 tons annually (Wikipedia), less than 1% of world production. Technical challenges, political instability, and disputes with indigenous communities have created this production paradox (GB Reports). President Luis Arce wants to develop the industry and aims for billions from lithium sales by 2025.

Chile: The 40-year-old production leader

Chile has turned smaller reserves into production leadership. With 9.6 million tons of reserves and about 140,000 tons produced yearly (Wikipedia), Chile is the world’s second-largest producer. Salar de Atacama provides perfect extraction conditions and is dominated by companies like SQM and Albemarle. Boric’s 2023 strategy increases state control through public-private partnerships (GB Reports).

Argentina: The emerging lithium powerhouse

Argentina ranks fourth in global production (Reuters) and produced 34,000 tons in 2023 (GB Reports). With 19.3 million tons of resources, operations are centered in Salta, Catamarca, and Jujuy. Provincial taxes are just 3% compared to 40% in Chile and 45% in Bolivia. Argentina’s output could quintuple by 2025 and even overtake Chile.

From Salt Flats to Battery Packs: The Global Supply Chain

Electric vehicles rely on a complex global supply chain starting with lithium extraction from salt flats. This “white gold” crosses continents before reaching your car battery.

Extraction methods in the Lithium Triangle

Miners drill holes into salt flats and pump mineral-rich brine to the surface (Harvard International Review). The brine sits in huge evaporation ponds for 12–18 months, leaving lithium-rich concentrate. This method uses about 500,000 gallons of water per ton of lithium (Harvard International Review).

In contrast, Australia extracts lithium by hard rock mining, with a significantly higher carbon footprint—37 tons of CO2 per ton, compared to 11 tons from brine extraction (MIT Climate Portal).

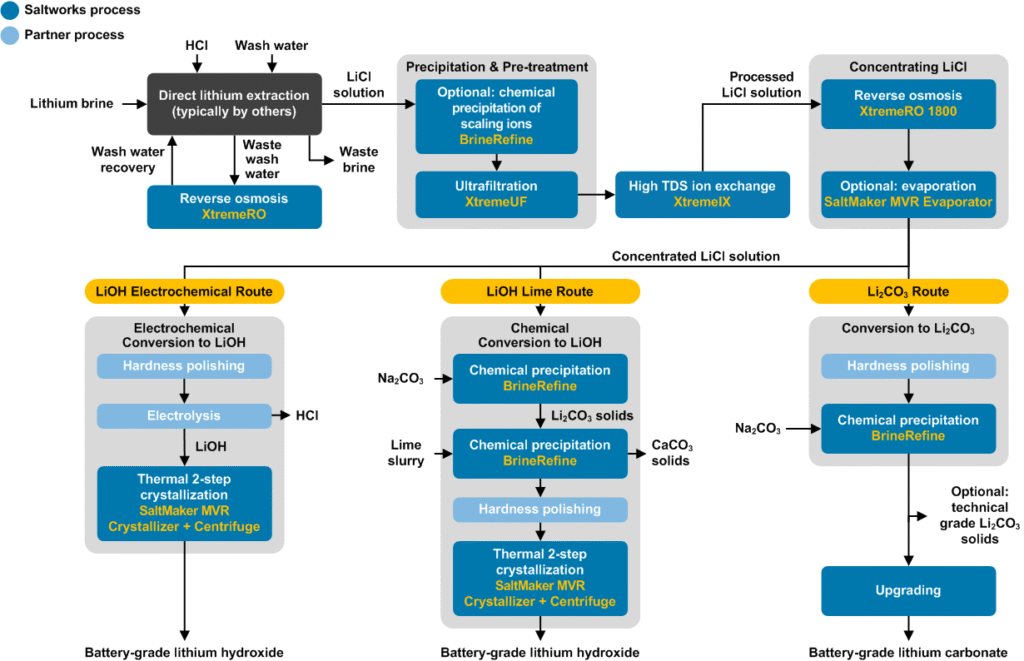

Processing and refining challenges

The concentrate requires further refining to produce battery-grade lithium carbonate or hydroxide with 99.5% purity (Lab Manager). China controls about 65% of global lithium processing (Wikipedia), and battery manufacturers now demand at least 99.99% purity.

Battery manufacturing bottlenecks

Bottlenecks may emerge by 2025 as EV production struggles to keep pace (Automotive Logistics). Experts predict a lithium shortage of up to 768,000 tons by 2030. Each EV requires about 12 kg of lithium (Euronews).

How lithium reaches your electric vehicle

Refined lithium becomes battery cathodes mostly in China, Japan, and South Korea (GCARD). About 74% of global lithium ends up in batteries (Innovation News Network). For example, a Tesla Model S battery uses about 12 kg of lithium.

Future Scenarios: Will South America Maintain Its Lithium Dominance?

The Lithium Triangle’s dominance faces new challenges from discoveries beyond South America. This could reshape the electric vehicle market in the next decade.

New lithium discoveries outside the triangle

China has increased its lithium reserves to 16.5% of the world’s total (The Hindu). New mines in Tibet and across the Qinghai-Tibet Plateau have fueled this growth.

The U.S. recently uncovered a huge lithium deposit at the McDermitt Caldera on the Oregon-Nevada border—estimated at 40 million metric tons (OilPrice). India has stepped into the race with 5.9 million tons of inferred lithium reserves in Jammu & Kashmir, which could make it the seventh largest source globally (Next IAS).

Technological disruptions

Direct Lithium Extraction (DLE) technology could revolutionize extraction, helping Argentina access its 21% share of global reserves more efficiently (Foley). This is expected to boost global supply by about 8%.

Political risks and state control

The biggest threats to stable supply come from political volatility and changing mining regulations (The Econ Review). Bolivia’s projects have faced delays due to state control, and Chile’s nationalization announcement signals growing state intervention.

Alternative battery technologies

Sodium-ion batteries use 682 times less water than lithium extraction and can be made in current lithium battery factories (BBC Future). Lithium-sulfur and solid-state batteries also offer higher energy density. Experts suggest diversification is the way forward, so South America’s grip might loosen in the decades ahead.

Conclusion

The Lithium Triangle faces a crucial turning point. These three nations control most of the world’s lithium reserves, but new discoveries in China, the U.S., and India could shift global power. Still, decades-old infrastructure and high-grade deposits ensure continued importance in the supply chain. The region’s future as the world’s main lithium source depends on how it adapts to tech changes and political shifts.

FAQs

Q1. What exactly is the Lithium Triangle and why is it important?

The Lithium Triangle is a region in South America spanning Argentina, Bolivia, and Chile that contains approximately 60% of the world’s known lithium reserves. It’s crucial for the global transition to electric vehicles and renewable energy storage, as lithium is a key component in rechargeable batteries.

Q2. How is lithium extracted in the Lithium Triangle?

Lithium here is mainly extracted from salt flats by brine evaporation—a process that requires significant water usage and time (12-18 months in large ponds).

Q3. Which country in the Lithium Triangle is currently the largest producer?

Chile is currently the largest lithium producer in the Lithium Triangle, producing around 140,000 tons annually. It’s the world’s second-largest producer overall, despite having fewer reserves than Bolivia and Argentina.

Q4. What challenges does lithium extraction face in this region?

Major challenges include high water usage, environmental impact, political instability, and increasing state control. There’s also growing competition from new lithium discoveries outside South America and the rise of alternative battery technologies.

Q5. How might the global lithium supply chain change in the future?

The future could see more supply from outside South America, new extraction tech, and alternative batteries, reducing the region’s dominance in the global market.

![The Surprising Truth About Beryllium Applications in Modern Technology [2025 Guide]](https://ik.imagekit.io/lxsotwajc/wpmedia/wp-content/uploads/2025/06/featured-Image3-440x264.webp)

Trackbacks/Pingbacks